Less than 10% of U.S. companies have reshored production in response to tariffs—despite years of political focus on bringing manufacturing home. That’s just one of several unexpected insights from our new survey of 500 professionals across manufacturing, construction, transportation, warehousing, and other industrial sectors.

As sweeping new tariffs continue to generate headlines, we look at how industrial businesses are responding—sometimes in ways that defy expectations.

This report breaks down what’s happening across three key areas:

-

- Operational impacts on the ground

- Gaps between business experience and public narrative

- How different sectors and regions are adapting—or struggling

Key Takeaways

-

- 55% of manufacturing professionals say tariffs have reduced their profit margins by 10–15%

-

- 75% of industrial businesses are passing tariff-related cost increases directly to consumers

-

- 45% of companies have reduced their workforce due to tariff-related cost pressures

-

- Only 9.8% of companies have reshored production despite tariff incentives

-

- Nearly 60% of respondents believe the media misses the mark about the impact of tariffs

-

- 38% cite inflation—not tariffs—as their biggest business challenge

-

- 30% of businesses saw unexpected benefits like customer gains or improved supply chains

-

- 70% of veteran business leaders are pessimistic about the long-term effects of tariffs

-

- The Midwest reported the highest rate of negative impact—with 50% expressing a negative outlook

Supply-Side Profit Margins Are Getting Hit Hard

Among manufacturing respondents, 55% reported that tariffs had cut profit margins by 10–15%. These are not mild fluctuations—they represent major hits to operating income. Many business leaders described this impact as a slow bleed on profitability, especially in sectors already operating on tight margins.

“We’ve had to renegotiate contracts mid-project,” one construction professional noted. “Steel prices alone blew our estimates out of the water.”

Tariffs have had a more direct impact on specific sectors: 59% of construction professionals and 55% of transportation companies cited product cost increases as a top unexpected impact. This was the most common surprise across all sectors (54% overall), according to our survey.

Consumers Are Paying the Price – Especially in Construction

While some businesses attempted to absorb costs, most found that wasn’t sustainable. A full 75% of respondents said cost increases were passed along to customers. That includes:

-

- 45.2% who raised prices

-

- 41% who tried to absorb costs (though many likely did so temporarily)

This has strained customer relationships. “Customer loss—people find alternatives and never return,” said a construction respondent from the South. In fact, 14% of all respondents cited customer loss as a surprise impact—rising to 16% in both the construction and transportation sectors.

Delayed Projects, Delayed Growth

In the construction industry, the unpredictability of material pricing has led to significant hesitation. About 52% of construction professionals said they had delayed or canceled projects due to tariff-related concerns.

“We’ve had to spend extra time reevaluating costs and negotiating with suppliers hit by tariffs,” one Southern firm shared. That uncertainty extends across planning, budgeting, and staffing—making it difficult for firms to scale or commit to new projects.

Quality and Supply Chain Headaches

Beyond pricing, businesses encountered a range of secondary effects from changing suppliers or reshuffling their sourcing strategies. Across all sectors:

-

- 12% reported supply chain disruptions

-

- 11% cited quality issues

-

- 6% experienced increased administrative burdens

Manufacturers were especially affected: 14% cited quality concerns as an unexpected challenge—more than any other sector.

Services Sector Must “Adapt or Die”

Despite the challenges, many companies responded with resilience. Around 40% said they’ve increased investment in automation or innovation to offset rising costs. One respondent in the professional services sector explained: “We pivoted quickly—automation is now at the core of our cost containment strategy.”

This innovation trend may indicate a long-term benefit: tariffs forcing productivity improvements—at least for companies that can afford the shift.

Reshoring Is Still Rare

One of the key goals of tariffs was to bring production back to the U.S. But this hasn’t happened at scale:

-

- Only 9.8% of businesses reshored production

-

- 64.4% made no significant supply chain changes

-

- 20.6% moved to domestic suppliers (not necessarily reshoring their own operations)

Most companies are adapting in other ways—raising prices, cutting costs, switching suppliers—not bringing jobs home.

Media Narratives vs. Business Realities in Operational Industries

Perceptions of Misinformation

Nearly 60% of respondents (58.6%) believe that the media misrepresents the impact of tariffs on American businesses. Only 41.4% said coverage has been accurate.

“It was a slap in the face to every business owner in America,” one Southern logistics manager said. “I don’t know how much longer we can hold out—but that never makes the news.”

This perception may reflect a broader disconnect between high-level political messaging and on-the-ground operational strain.

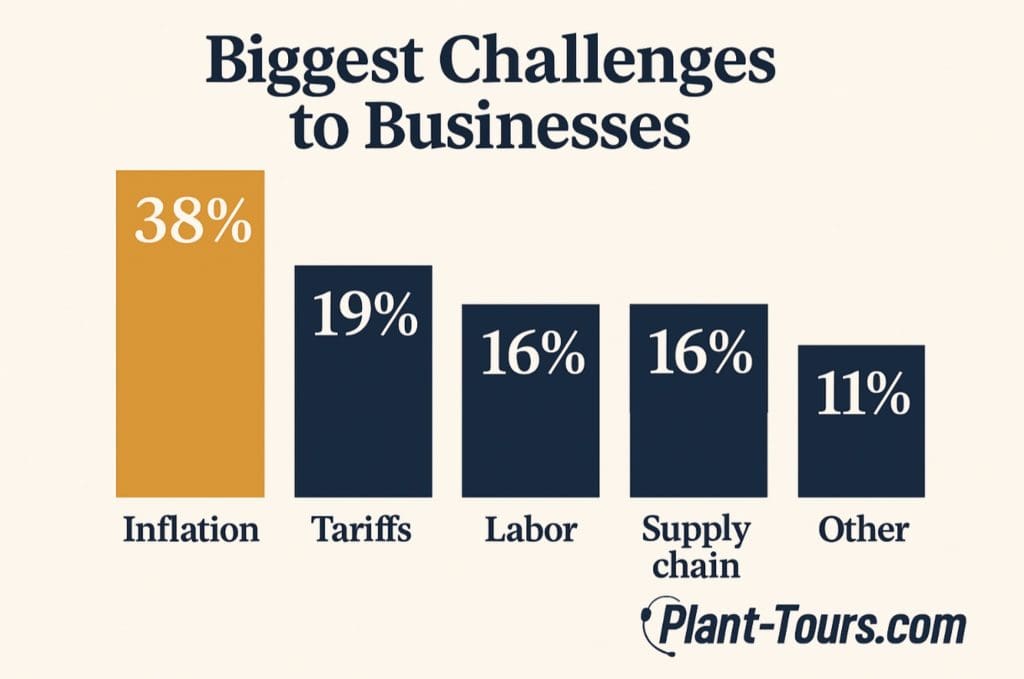

Inflation Outpaces Tariffs as Top Business Challenge

Although tariffs have clearly raised costs, businesses say they’re not the top concern. When asked to identify their biggest business challenge:

-

- 38% cited inflation

-

- 18.6% cited tariffs

-

- 16.4% cited labor shortages

-

- 16.2% cited supply chain delays

This reinforces a key insight: while tariffs matter, they’re only one of several overlapping pressures—and not necessarily the most urgent.

An Industry Divided – But Not Polarized

Tariff sentiment isn’t as binary as the political debate suggests. Survey results show.

-

- 41% of respondents oppose tariffs

-

- 21.4% support them

-

- 37.6% say they’re a mixed bag

As for how they perceive industry consensus:

-

- 38.4% said the industry is “somewhat divided”

-

- 31.6% said it’s mostly united against tariffs

-

- 14.6% said it’s mostly united in favor

In short: internal division is more common than clear alignment. Most companies are trying to adapt, regardless of political position.

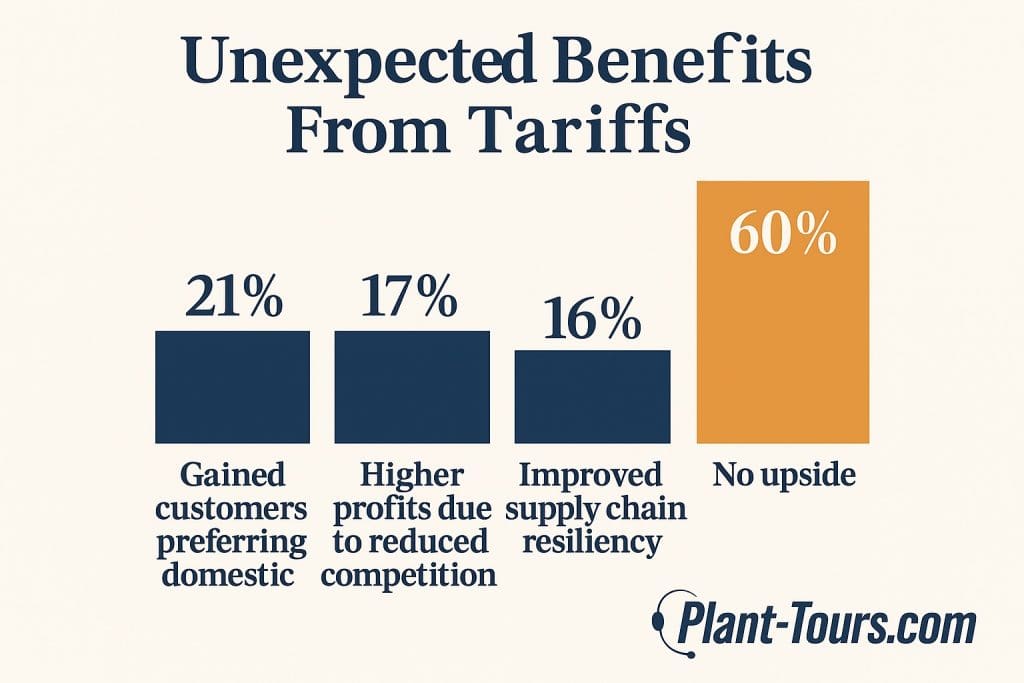

Some Companies Are Benefiting

Nearly 30% of businesses cited some unexpected upside:

-

- 21% gained customers preferring domestic goods

-

- 17% reported higher profits due to reduced import competition

-

- 16.4% improved supply chain resiliency

Still, these benefits were not widespread. 59.8% said tariffs brought no notable upsides.

One Southern automotive business shared: “Because we switched to U.S. suppliers, our customers are happy to pay the higher cost. That surprised us.

Where Tariffs Hit Hardest: Jobs, Regions, and Industries Under Pressure

Regional Divide

Our data shows that the regional impact of tariffs is uneven. When asked whether tariffs had noticeably affected their local economy or customer base:

-

- 41% of respondents in the West and South said yes

-

- 33% in the Northeast and Midwest said yes

But the Midwest reported the highest level of negative sentiment—50% of respondents there said the impact of tariffs had been harmful.

This suggests that traditional industrial strongholds may be more vulnerable to the compound effects of tariffs, inflation, and workforce strain.

Sector-Specific Surprise Impacts

-

- Construction saw the highest rate of product cost increases (59%) and customer loss (16%)

-

- Manufacturing reported more quality issues (14%) than other sectors

-

- Transportation had fewer supply chain complaints (8%) but matched construction in customer loss (16%)

These differences matter when crafting regional or industry-specific policy—and when evaluating claims that certain sectors are “winning.”

Generational Outlook on Trade Policy

Attitudes toward long-term outcomes vary sharply by leadership age:

-

- 70% of veteran business leaders expressed pessimism about the long-term impact of tariffs

-

- Only 55% of younger entrepreneurs shared that view

This gap may reflect different levels of exposure to global supply chains, or contrasting views on resilience and risk tolerance.

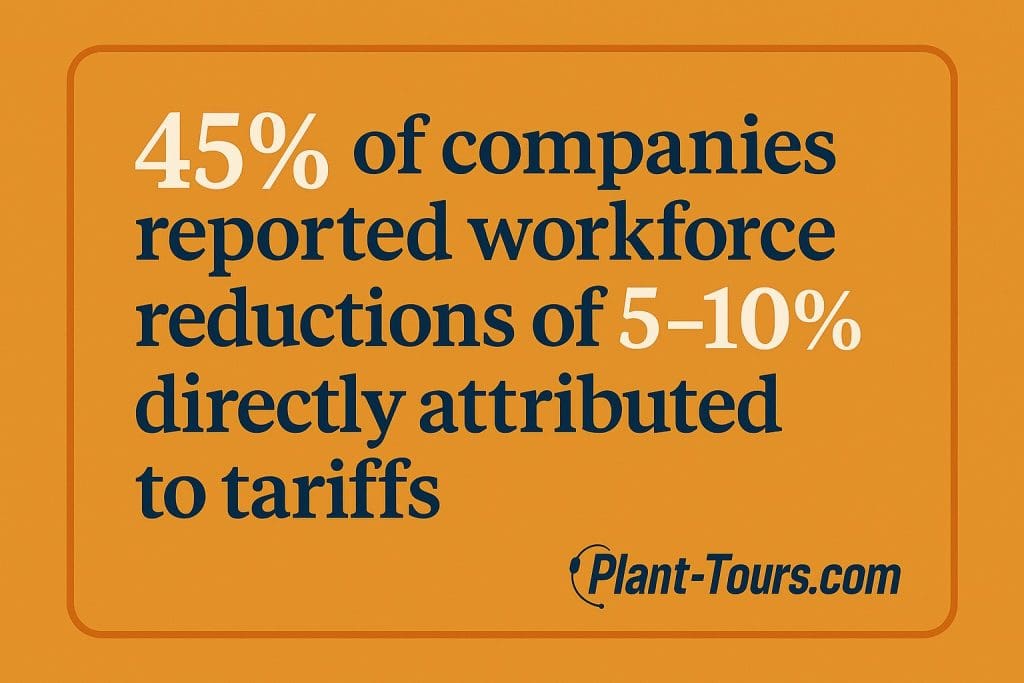

Workforce Reductions Are Widespread

One of the most consequential findings: 45% of companies reported workforce reductions of 5–10% directly attributed to tariff-driven cost pressures.

This isn’t just a supply chain story—it’s a labor story, too. The loss of jobs due to margin compression and reduced demand undercuts the idea that tariffs are universally pro-worker.

Conclusion

Our survey paints a detailed, balanced picture of how tariffs are affecting American industrial sectors. While costs are up and some are struggling, others are adapting—and a few are even thriving.

Tariffs are only part of the economic pressure cooker. Inflation, labor shortages, and delayed supply chains are often more pressing problems. And while reshoring hasn’t occurred at a meaningful scale, innovation and automation are helping some businesses weather the storm.

Policymakers and media outlets alike would do well to recognize this complexity—and resist the urge to paint tariffs as either a patriotic success or an outright economic failure. As this data shows, the truth lies somewhere in between, and the real story is still unfolding.

Methodology

We surveyed 500 managers and executives across American manufacturing, construction, transportation, warehousing, and related sectors to explore the impact of Trump-era tariffs. The sample included 40% women and 60% men. Respondents identified as 65% white, 15% Black, 10% Hispanic, 8% Asian, and 2% identifying as another ethnicity.

By industry, the breakdown included 45% in manufacturing, 25% in construction, 20% in transportation and warehousing, and 10% in other related sectors. The average annual income across all respondents was $85,000.

Author’s Note

Some of the top industry markets for us include food/beverage, automotive, and construction. Each of these are being buffeted by these recent tariff actions. It’s PlantTours’ job to consistently provide ideal solutions for each of our customers’ facility communications needs. Due to our extensive inventory of all tour guide systems and products in our on-site facilities, we are always prepared to serve them without delay.